While the electronic age has introduced a myriad of technical solutions, How To Do Depreciation In Excel stay a timeless and sensible device for numerous facets of our lives. The tactile experience of interacting with these templates gives a feeling of control and organization that matches our hectic, digital presence. From improving performance to assisting in imaginative pursuits, How To Do Depreciation In Excel continue to show that sometimes, the most basic services are one of the most effective.

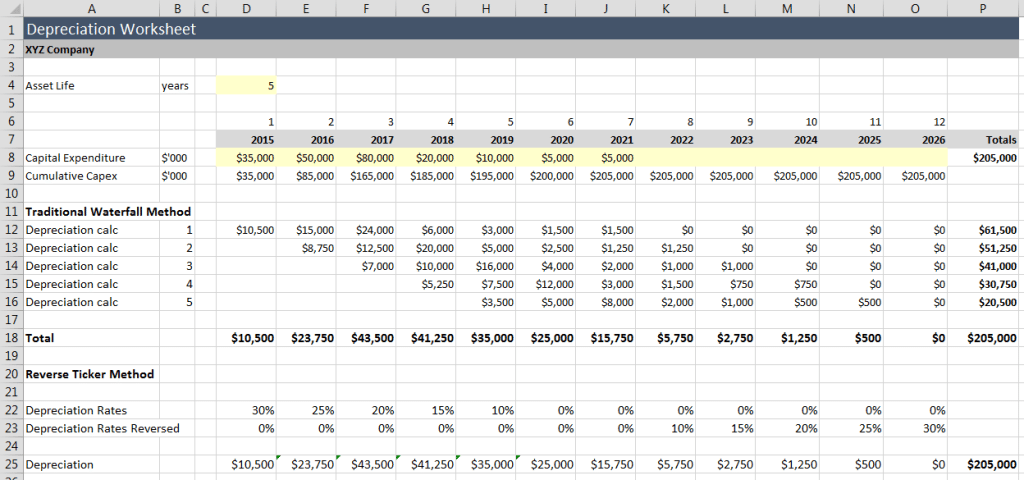

Accumulated Depreciation Formula In Excel BrookLalayne

How To Do Depreciation In Excel

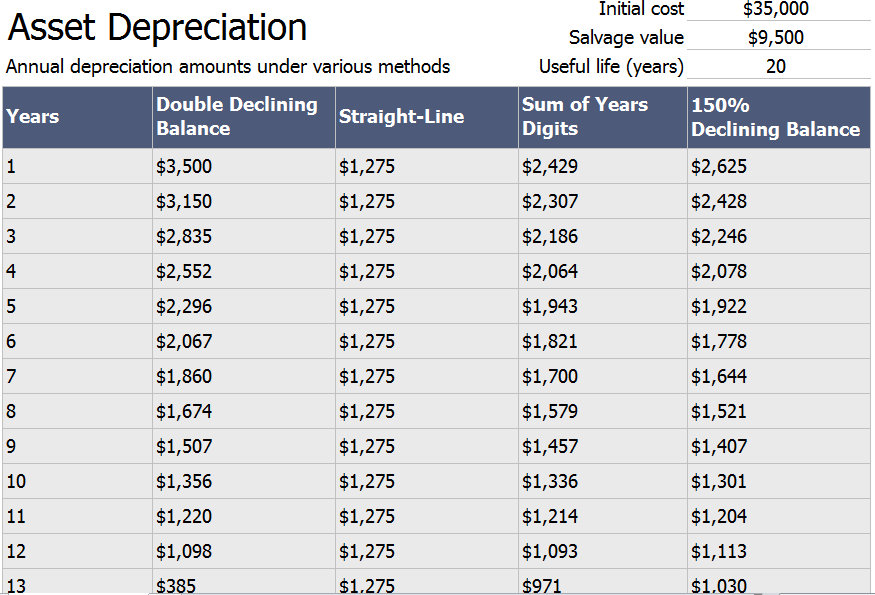

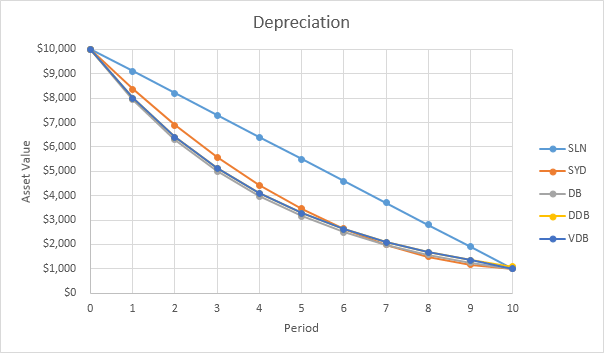

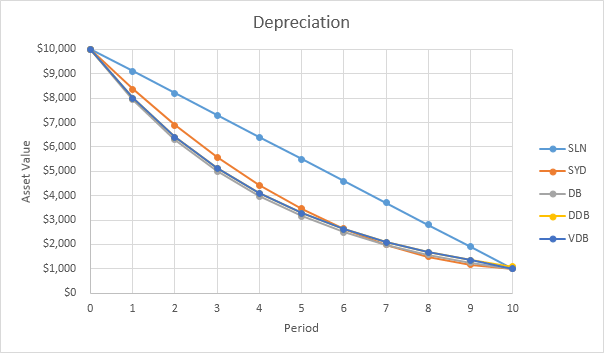

Excel offers five different depreciation functions We consider an asset with an initial cost of 10 000 a salvage value residual value of 1000 and a useful life of 10 periods years

How To Do Depreciation In Excel also locate applications in wellness and health. Physical fitness coordinators, meal trackers, and rest logs are just a couple of examples of templates that can contribute to a much healthier lifestyle. The act of physically filling in these templates can impart a sense of commitment and discipline in adhering to personal wellness goals.

Depreciation Tax Shield Formula MarieaArshad

Depreciation Tax Shield Formula MarieaArshad

Excel has the DB function to calculate the depreciation of an asset on the fixed declining balance basis for a specified period The function needs the initial and salvage costs of the asset its useful life and the period

Musicians, writers, and developers frequently turn to How To Do Depreciation In Excel to jumpstart their innovative jobs. Whether it's laying out ideas, storyboarding, or intending a design layout, having a physical template can be a valuable beginning factor. The adaptability of How To Do Depreciation In Excel enables creators to iterate and improve their job until they attain the desired outcome.

Hecht Group How To Read A Depreciation Schedule

Hecht Group How To Read A Depreciation Schedule

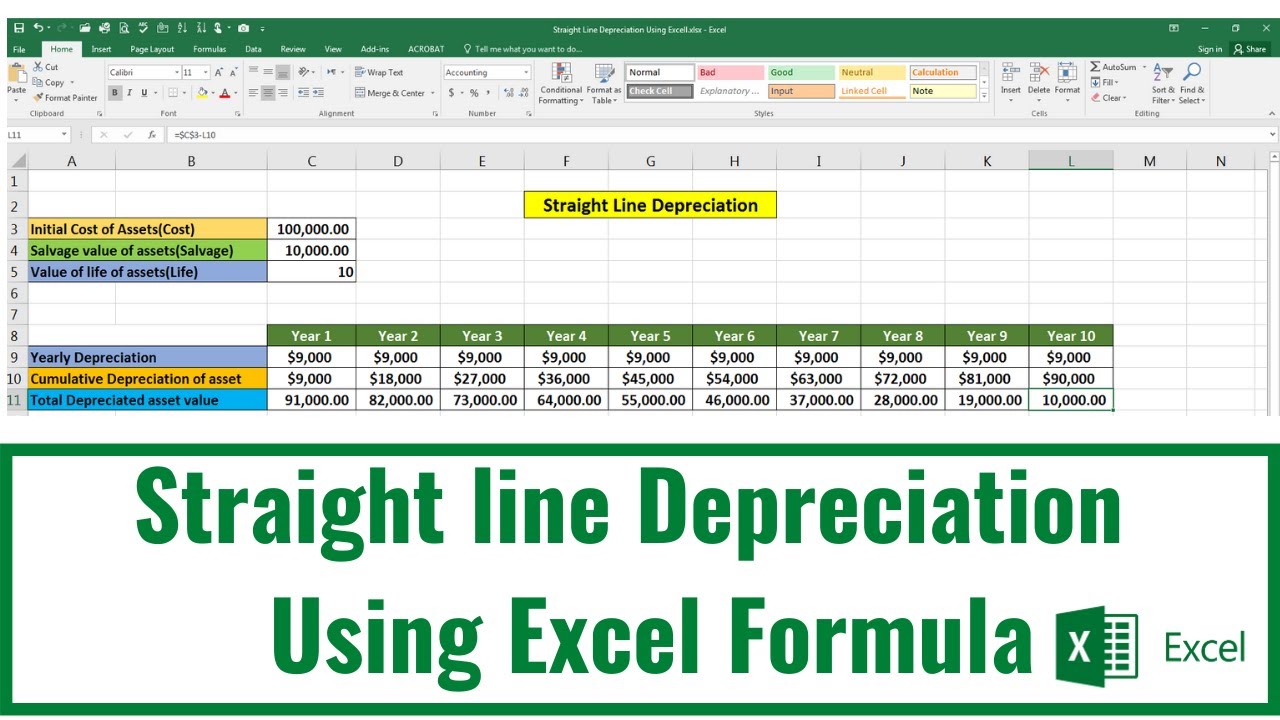

During this tutorial you will learn how to calculate depreciation with Excel using five different functions the straight line method the declining balance method the sum of the year s digits method the double declining

In the professional world, How To Do Depreciation In Excel use a reliable method to take care of jobs and projects. From service plans and job timelines to invoices and expenditure trackers, these templates streamline essential business procedures. Furthermore, they provide a tangible document that can be easily referenced throughout meetings and discussions.

How To Calculate Depreciation To Date Haiper

How To Calculate Depreciation To Date Haiper

Excel is capable of calculating any depreciation method including The declining balance method using the DB function The double declining balance accelerated method

How To Do Depreciation In Excel are widely used in educational settings. Educators usually rely upon them for lesson strategies, classroom activities, and rating sheets. Pupils, also, can take advantage of templates for note-taking, study schedules, and job preparation. The physical visibility of these templates can enhance interaction and act as substantial help in the discovering procedure.

Download How To Do Depreciation In Excel

https://www.excel-easy.com/examples/…

Excel offers five different depreciation functions We consider an asset with an initial cost of 10 000 a salvage value residual value of 1000 and a useful life of 10 periods years

https://spreadsheetweb.com/how-to-calcula…

Excel has the DB function to calculate the depreciation of an asset on the fixed declining balance basis for a specified period The function needs the initial and salvage costs of the asset its useful life and the period

Excel offers five different depreciation functions We consider an asset with an initial cost of 10 000 a salvage value residual value of 1000 and a useful life of 10 periods years

Excel has the DB function to calculate the depreciation of an asset on the fixed declining balance basis for a specified period The function needs the initial and salvage costs of the asset its useful life and the period

Depreciation Percentage Calculator DanikaJaden

Depreciation Schedule Template Excel Free Free Printable Templates

Straight Line Depreciation Formula Calculator Excel Template

How To Calculate Depreciation In Excel Excel Examples

Depreciation Excel Template Database

Free MACRS Depreciation Calculator For Excel

Free MACRS Depreciation Calculator For Excel

Accumulated Depreciation Formula Calculator with Excel Template